We wondered, is the market ready for Croissant’s fresh, new “buy now sell later” BNPL model? Investors think so with $24 million to backup their conviction it will sell. Prime marketplace Poshmark added Affirm’s Adaptive Checkout and results are encouraging. Klarna dumped its open banking brand Kosma but will retain the services within the global Klarna brand.

India’s ZestMoney provides a cautionary tale of high risk BNPL fintech growth according to some industry analysts. Kenya’s Safaricom launched BNPL services for more than 32 million customers with partner fintech EDOMx. Oppty and Triple-A introduced cryptocurrency payments to more than 90 BNPL operators in 120 countries. Oh, did you know digital bank Zopa acquired UK’s DivideBuy in Feb? Price undisclosed.

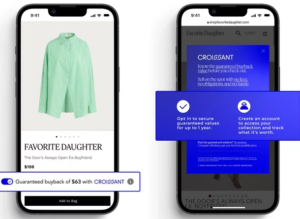

Is Croissant’s buy now sell later a fresh BNPL model?

Early-stage fintech Croissant launched a buyback model that lets shoppers sell items back for an agreed resale price – so can we call it buy now sell later? Shoppers get a guaranteed ‘buyback’ value at the point of sale, and a chance to sell the item back within a year. An AI-powered algorithm determines the buyback price, with Croissant fulfilling the buyback guarantees. Investors Portage and KKR bet $24 million in seed capital that it will sell. FinTech

Social marketplace Poshmark adopts Affirm’s Adaptive Checkout

Poshmark will add Affirm’s Adaptive Checkout – which delivers Pay in 4 and monthly payments in an integrated checkout flow for shoppers. With Adaptive Checkout, Poshmark can lower the floor price limit to $50 and offer the ability to pay in four installments with Affirm, alongside monthly payment options, making Poshmark accessible to a broader audience of buyers. Affirm

Klarna dumps open banking brand Kosma

Klarna has tossed its open banking brand Kosma just one year after launching. The business will operate as before under the Klarna brand, providing FS apps and services by providing simple and secure access to 15,000 banks in 24 countries through a single API. It entered open banking after acquiring Sofort, a direct bank-to-bank payment service in Germany, in 2014. Finextra

Risky business: BNPL startups’ survival a cautionary tale of India’s high growth fintech

Capping default guarantees, shaky levels of default rates, a big rise in marketing costs, and waning VC interest may negatively impact companies in the buy-now-pay-later space. ZestMoney, smarting under the collapsed merger with Walmart-backed fintech PhonePe, was hit hard last month. A group of its NBFC (non-banking finance company) partners met the buy now pay later (BNPL) startup’s newly appointed management and issued an ultimatum. The Economic Times

Safaricom’s BNPL service launches

EDOMx, a Kenya-based fintech, joined with Safaricom to launch a BNPL service called “Faraja” after approval from Kenya’s Central Bank in March. Over 32 million Safaricom customers can now buy products and services on credit installments using the popular Lipa Na M-PESA mobile money platform in Kenya. Faraja allows users to make purchases ranging from KSh 20 to KSh 100,000 ($704) with zero interest fees and a 30-day payment period. Kenya Wall Street

Optty and Triple-A expand payment architectures into cryptocurrencies

Universal payments platform Optty announced a partnership with crypto payment gateway Triple-A to add cryptocurrency as a payment option on the platform. The central hub connects a global network of over 90 BNPL providers, marking the launch of Optty’s sixth payment architecture, and expanding available payment options for merchants and convenience for customers in over 120 countries. Cision

Digital bank Zopa acquires UK BNPL firm DivideBuy

“The acquisition let’s customers finance larger purchases — £250 ($318) to £30,000 ($38,235) – that would otherwise take months or years to save up for. Zopa says its BNPL lending will only offer affordable credit by “running credit checks and affordability assessments for all customers,” the company said in a Feb news release. PYMNTS