Morning Consult reported that young, well-off BNPL users are growing a “mountain of debt.” The New York Fed report has analysts talking about fragile users, potential future money troubles and yet more inclusion for under-banked consumers. Meanwhile, research by BNPL provider Mollie shows BNPL service providers benefit from a return of consumer confidence.

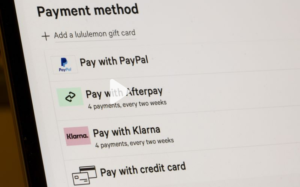

With the average BNPL customer having four installment loans, fintech Cushion built an app that helps consumers track their loans and payments. Smart idea. Linas Beliunas looks into affiliate payments as a nimble revenue-generating strategy for Klarna. A Singapore BNPL jobs scam is worth watching for other BNPL providers. Payments provider Citcon partners with CashApp and Afterpay to help merchants

BNPL users: Young, well-off, amassing a mountain of debt

BNPL users could be on the precipice of financial hardship from debt overload, writes Morning Consult financial services analyst Jaime Toplin. 20% of US adults made a BNPL purchase in August. Users tend to be young, mid- to high-income, tech-savvy adults but are more likely to carry debt than the general population. The report noted users have less access to, and less satisfaction with, financial service providers. Morning Consult

NY Fed: Many BNPL users are financially fragile

BNPL installment payment offerings appear to be disproportionately used by people facing financial difficulties, raising concerns about the potential for greater money trouble, according to research from the Federal Reserve Bank of New York. “The fact that a disproportionate share of BNPL users are already financially fragile raises questions about the resilience of BNPL lending and its performance following an adverse economic shock,” New York Fed researchers wrote. CNN

Buy now, pay later loans expand financial inclusion: Fed report

Consumer advocates are pushing regulators to rein in the upstart BNPL loan industry, but it’s difficult to pinpoint the extent of harm from fintech lenders, reports the Federal Reserve Bank of New York. While financially vulnerable consumers are more prone to use BNPL loans from fintechs like Affirm, Afterpay and Klarna, the products’ use spans a wide demographic and socioeconomic group. For some consumers, these loans can help users smooth out debt payments at a lower cost than traditional loans. American Banker

BNPL benefits as consumer confidence returns – Mollie report

BNPL is the big winner as consumer confidence slowly improves, according to the findings of a new survey from payments firm Mollie. Over half (56%) of consumers say they’re using buy now pay later more often now than a year ago, suggesting a resurgence in popularity for a payment method that found prominence during the COVID-19 lockdown. 38% of consumers have never used BNPL, despite its prominence and rising to almost half (49%) in Germany. FinTech

Keeping track of multiple BNPL loans? There’s an app for that.

Cushion CEO Paul Kesserwani felt overwhelmed when he tried to keep track of several BNPL loans at once, so he shifted his fintech’s focus to help others in the same boat. According to Bankrate, the average BNPL customer has four concurrent BNPL loans, and more than half of BNPL customers surveyed report falling behind on payments. Cushion may help users with a softer landing. BankingDive

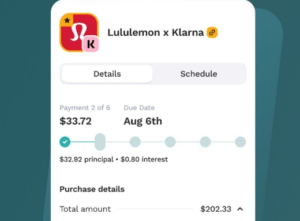

Klarna’s strategy that nobody’s talking about

In the beginning of September, Swedish FinTech giant and BNPL pioneer Klarna hit a profitable month for the first time in three years. One of the key drivers of that is Klarna’s rapidly growing affiliate marketing business, which also is a wise way to diversify revenue. Take a closer look at Klarna’s brilliant strategy, which also serves as a blueprint for other BNPL players and fintechs. Linas’s Newsletter

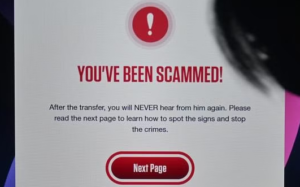

Three arrested in Singapore BNPL job scam

Three Singapore residents were arrested over their alleged roles in a series of job scams involving a buy now pay later service. Victims would be asked to create a BNPL account and hand it over to the fraudsters as part of a “job requirement.” Their BNPL accounts were then used to make purchases at electronic stores, and these items were later resold, resulting in more than $76,000 in fraudulent purchases. At least 32 victims had responded to social media posts advertising “fast cash” opportunities. The Straits Times

Citcon launches BNPL option for e-commerce businesses

Citcon, a global provider of digital payments, announced a strategic partnership with Cash App Pay and Afterpay to empower e-commerce businesses with a lineup of payment solutions through Citcon. By leveraging Cash App Pay and Afterpay’s popular BNPL service, merchants can deliver a streamlined experience that caters to modern consumer preferences for more payment options from more than 150. IBS Intelligence

What is Hoolah?

Launched in 2018, Hoolah is a Singaporean fintech company that initially focused on providing a buy now pay later service for online and offline retail purchases. In 2020, it rebranded itself as “ShopBack,” adding cashback and rewards for shoppers on the platform. ShopBack has expanded its services across Southeast Asia and is considered one of the region’s leading cashback and rewards platforms. Cantech Letter