New Philadelphia Fed research shows BNPL users seek and use more credit but don’t have statistically more credit than non-users. A YouGov report finds that BNPL accounts for 8% of shoppers and users say rewards would improve their service satisfaction. Other research shows the use of BNPL for smaller purchases, and groceries and apparel are the most popular categories.

IKEA partnered with Afterpay to add BNPL to the menu along with the usual SJÖRAPPORT salmon and meatballs. WooCommerce picks Sezzle to expand installment payments for its e-commerce platform merchants. Klarna reported affiliate marketing made up 10% of revenue in 2022 as it moves closer to becoming more bank-like. A CNBC report says BNPL operators may face serious headwinds if lenders lose their taste for riskier consumer loans. India’s BNPL user base will exceed 100 million by 2027, and BNPL is now the 7th most popular payment method.

BNPL users seek, use more new credit Fed study finds

Researchers with the Philadelphia Fed’s Consumer Finance Institute found BNPL use doesn’t affect short-term use credit scores. But, they also discovered a typical BNPL user’s credit score was more than 50 points lower than a non-user’s. Users of BNPL pursue and obtain more new credit lines, but even with increased “shopping intensity,” BNPL users didn’t use a statistically significant higher amount of credit than non-users. PaymentsDive

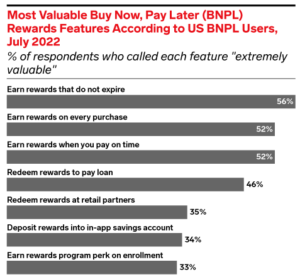

BNPL firms have to get creative to offer rewards that rival credit cards

The number of US consumers who used buy now pay later may have doubled since 2021, per a YouGov report, but they still only account for 8% of shoppers. 38.1% of respondents said rewards would improve their satisfaction with BNPL providers. The average consumer is already active in seven loyalty programs and wants BNPL to be next. Better store availability (32.5%) and higher credit limits (32.1%) rounded out the top three wants. Insider Intelligence

Smaller purchases on the rise: groceries and apparel emerge as popular US BNPL categories

According to recent research, BNPL services in the US experienced a decline in usage in 2022. While the value of BNPL payments is projected to nearly double between 2022 and 2026, the growth rate of BNPL payments is expected to decrease during that period significantly. BNPL ranked last among payment methods used at least five times monthly in North America, with a low single-digit percentage. Suggesting the initial surge in BNPL adoption in the US has slowed down. Yahoo Finance

IKEA and Afterpay bring BNPL to furniture buying

IKEA has entered the buy now, pay later (BNPL) space with the help of Afterpay. The world’s largest furniture retailer announced Tuesday (Sept 19) that Afterpay’s “Pay in 4” service was now available at its stores and website for customers in the US. The program, which lets customers pay for products in four payments over six weeks, is launching at a time when cost-conscious consumers continue to use deferred payment offerings like BNPL to fund purchases. PYMNTS

Sezzle and WooCommerce expand partnership for flexible payment options

Sezzle announced an expanded partnership with WooCommerce, the leading open-source eCommerce platform, making it easier for WooCommerce merchants to integrate Sezzle’s BNPL solution into their checkout process, providing their customers with flexible and convenient payment options. Sezzle’s solutions also enable customers to build their credit, providing them with a responsible way to pay over time. Sezzle is a certified B Corp with a mission to empower the next generation financially. Sezzle

As Klarna aspires to be a global bank, affiliate marketing is its cash cow

A new revenue stream emerging for Klarna is affiliate marketing, a practice that dates back to the beginning of e-commerce. In its 2022 annual report, the company said its overall “marketing revenue” had more than doubled in the year and that “affiliate marketing revenue “in the fourth quarter was SEK 1.6bn ($144 million) or 10% of total global revenue in that period. Sifted

Merchants face increased risks beyond the cost of living crisis

According to CNBC, over 92% of consumers have cut their purchases of non-essential items over the past six months. If lender appetites for risk decrease, merchants offering BNPL could face new challenges as they navigate the range of checkout financing options that will minimize costs and upheaval to the checkout process. The solution to vulnerable dependency on a single lender is to diversify. However, this can raise overhead costs and complexity for merchants. Fintech Nexus

India’s BNPL future looks bright: User base expected to quintuple to surpass 100 million by 2027

More adults in the APAC region completely trust BNPL services rather than completely distrusting them, setting the stage for significant growth in BNPL adoption. BNPL has also become one of the region’s top seven payment methods used at least five times per month. India is poised to triple from 2022 to 2026, driven by a mid-range double-digit CAGR. The number of BNPL users in India is projected to nearly quintuple from 2022 to 2027, surpassing 100 million. Cision