Research shows by 2027, Klarna could have 37.5 million users and handle $33.38 billion in payments. Meanwhile, Klarna presses forward with AI to fuel usage of its super app. Sezzle had a bumpy few days after the first trading on NASDAQ as a shortage of available shares caused a trading halt as it transitioned from the Australian stock exchange. Homegrown LATAM BNPL operators and their new technology are serving growing numbers of the 178 million unbanked consumers across the region.

A new Consumer Reports study shows growing concern about the risk of BNPL loans for some consumers who need better financial literacy. India’s market for equal monthly installments (EMIs) is growing at 22.9% and is on target to reach $14 billion by 2024. Bangladesh’s Pathao Digital Bank reached 10 million users; its Pathao Pay Later service now has more than 100,000 users. New research shows alternate payment methods and mergers and acquisitions are shaking up the market in a difficult economy.

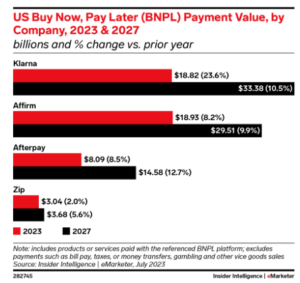

By 2027 Klarna will lead US BNPL payment value

In four years, Klarna will generate $33.38 billion in US BNPL payments, surpassing Affirm in a massive industry growth period. Klarna has continued to build its BNPL services and grow its user base, including a recent partnership with Airbnb. Gen Z will drive growth, but Gen X and baby boomers will help make up 37.5 million users by 2027. Insider Intelligence

Klarna going ‘all in on AI’ to fuel super-app push

Klarna is “going all in on AI” as it looks to push beyond its buy now pay later bread and butter and take on banks on cheap lending, its global chief has said. In a recent blog post, CEO Sebastian Siemiatkowski said the Swedish fintech firm will ramp up its investment in AI to roll out new shopping and lending products for customers that could undercut bigger banks. City A.M.

Sezzle trading halted on NASDAQ

NASDAQ halted trading in Sezzle common stock, advising the company of inadequate publicly available shares of common stock to make a market and facilitate proper trading due to a large number of shares of common stock still held by investors in the form of Chess Depository Interests (CDIs) for trading on the Australian Securities Exchange (ASX). Sezzle is working with NASDAQ to resolve the situation. Sezzle

Sezzle stock halted due to public shares shortage

Trading of Sezzle shares was halted on their first day of trading on NASDAQ after the exchange said there were not enough publicly available shares to make a market. Sezzle has a large number of shares of common stock held by investors through the Australian Securities Exchange. The company’s common shares were approved Thursday for listing on Nasdaq and began trading under the ticker SEZL. The stock nearly quadrupled in price before being halted. MarketWatch

Homegrown LATAM BNPL providers reaching underserved consumers

BNPL services help finance more expensive purchases through non-traditional channels but only made up 1% of total e-commerce in the region in 2021. Brazil and Mexico are the biggest markets in terms of people and sales volume, but many are underbanked or unbanked. Native BNPL operators know Latin America is not a monolithic market of 300 million buyers and have developed their own risk models accordingly to reach the estimated 178 million underbanked customers. Payments Journal

BNPL risks raise questions for Consumer Reports

Consumer Reports senior policy counsel said BNPL’s ubiquity and growing use for everyday purchases should grab regulators’ attention. Jennifer Chien’s July report suggests policy recommendations to better protect BNPL users from becoming overextended by the loans or from having their data harvested. She is especially concerned about growing use of BNPL for everyday products and daily essentials. PaymentsDive

Why Indian BNPL firms need to balance responsibility and convenience

Equal monthly installments (EMIs) are a popular payment model in India. EMIs show an annual growth rate of 22.9%, with a large market share in India’s tier 2 and 3 cities. Sales value is expected to reach approximately $14 billion by 2024, despite some rates between 10-30% based on credit scores and type of transactions. The industry must do more to increase financial literacy and understanding of risks. Moneycontrol

Pathao awaits Bangladesh regulatory approval for its digital bank

Pathao Digital Bank will mark a ‘natural evolution’ of the company’s user base of 10 million consumers and half a million drivers, delivery agents, and SME entrepreneurs. The company highlighted its Pathao Pay Later service, the country’s largest BNPL solution with over 100,000 platform users while maintaining notably low delinquency rates since launching in Nov 2021. Over 1.1 million agents handle more than 10 million daily transactions in the mobile financial service network. BDNews24

M&As, alternative funding keep fintechs afloat amid ongoing economic shake-up

The fast-growing buy now, pay later (BNPL) sector, in particular, has been affected as higher interest rates have made it difficult for providers to offer interest-free payments, leading to significant losses for key players. From Klarna and Affirm to Zip, stock prices and valuations have plummeted, accompanied by a widespread trend of mass layoffs and cost-cutting strategies. PYMNTS