Analysts and investors liked Affirm’s latest financial results, which included a 22% increase in revenue and 32% growth in transactions. CFO Michael Linford said the “business is really on fire.” Jifiti CEO Yaacov Martin says BNPL is building a new heart for consumer retail financing. Zip moved up as losses narrowed and revenues and transactions grew year-over-year. Splitit caught a lifeline from lender Goldman Sachs despite continued losses.

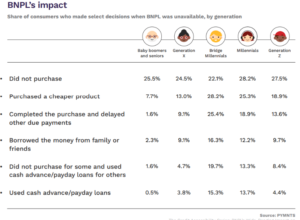

Mondu and Spryker joined forces to offer small businesses more B2B installment payment options. NymCard and Visa introduced new services, including card issuance, BNPL and gift cards. PYMNTS and Sezzle research showed BNPL’s resilience as fashion sales jumped 14%, followed by 61% growth in general merchandise installments. 40% of consumers said they would postpone buying or buy a cheaper product if BNPL was unavailable.

Affirm stock advances as BNPL company easily tops revenue expectations

Despite the current high-interest environment, Affirm Holdings shares jumped nearly 7% higher in after-hours trading after the buy-now-pay-later operator topped expectations with its latest results. It posted a net loss of $206 million, or 69 cents a share, compared with $186.4 million, or 65 cents a share, in the year-earlier period. Revenue rose to $446 million from $364 million, where analysts expected $406 million. MarketWatch

Affirm CFO on buy now pay later: ‘Business is really on fire’

Affirm (AFRM) shares climbed higher after the company saw revenue jump 22% year-over-year and transactions climb 32%. Affirm CFO Michael Linford discusses the Q4 results, the outlook for the business, GMV, and the state of the consumer. Linford said, “We have really dialed in our credit performance and controlled the outcomes that we need to control to perform well … I think that’s really what investors are looking for us to do right now.” Linford added, “The way consumers are paying for things is fundamentally changing, and Affirm is best positioned to capture and harness that change. Yahoo Finance

Affirm soared today – Is the BNPL business doing well?

Affirm reported its fiscal fourth quarter’s earnings and the numbers beat expectations. Not only did revenue in the latest fiscal quarter grow by 22% year over year (YOY) despite the challenging economic climate, but it also came in significantly better than analysts had expected. Gross merchandise volume through Affirm’s platform was $5.5 billion, up 25% from the same quarter a year ago. It now serves more than 16.5 million users and 245,000 merchants. The Motley Fool

Mondu and Spryker team up to provide B2B BNPL

B2B payments company Mondu has partnered with composable commerce platform Spryker to offer flexible payment solutions to more B2B buyers and help businesses increase their online sales and revenue. Mondu’s BNPL solutions include payment on invoice, Single Euro Payments Area (SEPA) direct debit, and installments, allowing businesses to offer flexible payment solutions. PYMNTS

Yaacov Martin, Co-Founder & CEO of Jifiti | Episode 252

Martin’s insights will forever change how you perceive financing significant purchases, from furniture to medical procedures and even distance learning. More than just a business model, the BNPL industry represents a key bridge between merchants, consumers, and banks – a bridge that Jifiti is leading the way in building. Dive into the heart of the revolution with us as he details Jifiti’s journey through the trials of integrating BNPL into retail ecosystems. Leaders in Payments Podcast

Goldman Sachs throws Splitit a lifeline

Splitit continued to rack up losses in the June half as it moved to reassure the market it has the continuing support of its lender and major shareholders. Splitit reported a loss of US$12.5 million for the six months to June, similar to the loss of US$12.2 million in the previous year. Revenue was up, but so were operating expenses and finance costs. In May, it amended its credit facility agreement with Goldman Sachs and raised US$10 million from its two largest shareholders. BankingDay

Zip loss narrows, volumes rise as BNPL adapts to downturn

Zip Co’s new CEO, Cynthia Scott, said the buy now, pay later provider’s latest full-year result will be the last when it runs at an epic loss, and it expects growing demand from customers turning to its credit products to cope with the rising cost of living. Zip is still running a hefty annual statutory loss, $413 million over the year, but reported record transaction volumes and revenue, suggesting there may still be some life in the buy now, pay later sector. Australian Financial Review

Visa partners with NymCard to launch issuance platform

Visa launched the Visa Ready to Launch (VRTL) program to provide fintech and non-banking entities with a seamless experience in issuing payment products. NymCard is the first Middle East and Pakistan area BaaS participant to join the VRTL program and improve payment credentials issuance capabilities for fintech through a plug-and-play end-to-end platform with pre-designed bundles of in-house and outsourced solutions, Including card issuance, BNPL, multicurrency, and gift cards. The Paypers

Growing BNPL use shows discretionary spending resilience

In recent weeks and months, joint research between PYMNTS and Sezzle has underscored the embrace of buy now pay later at checkout. Fashion and beauty volumes were up 14% year on year in the June quarter, and general merchandise was up 61%. Recent research showed more than 40% of the 3,000+ consumers surveyed said they’d delay a purchase – or opt for a cheaper substitute – if BNPL was not offered. PYMNTS