NMG research finds 11% or 3.1 million UK households owe more than $3.3 billion on BNPL loan services or what it calls “shadow credit.” Param’s Twisto acquisition reflects Turkey’s fintech expansion, including BNPL. Koverly plans a unique B2B BNPL offer on FX payments at no cost. New Zealand’s HealthNow closed quickly, surprising many using the healthcare platform. Klarna saw 26% growth in UK BNPL second-quarter sales and 13% across Europe.

Amazon says tens of thousands of merchants can enable customer installments using Amazon Pay. UK fintech Zorrz will use Sileon’s BNPL platform to launch a buy now pay later credit card by the end of the year. ShopBack and Malaysian payment gateway PayHalal announced plans for a Sharia-compliant BNPL merchant platform. BNPL’s rapid growth accelerates the ethical debate over short-term lending services.

Shining a light on BNPL users of shadow credit

NMG data suggests 11% or 3.1 million UK households reported owing money on BNPL. The mean balance was £866, implying an outstanding aggregate BNPL balance of around £2.7 billion ($3.3 billion). The distribution of balances is skewed. Many BNPL users report a few hundred pounds or less balances, with a small number reporting much larger balances. The median balance of users is £300, and the 90th percentile is £2,000. Bank Underground

Turkish fintechs are shopping in Europe

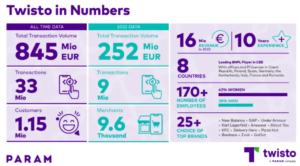

Embedded finance provider Param, one of Turkey’s largest fintechs, recently acquired Czech BNPL firm Twisto. Founded in 2013, Twisto is one of the leading BNPL platforms in Central Europe and calls itself the Klarna of the East. It was acquired by Zip Co in 2021. Through Twisto’s European licenses, Param plans to offer its embedded finance services aimed at SMEs and large companies, initially in the UK, Germany, Netherlands, Czech Republic, and Poland. Linas’s Newsletter

Koverly launches B2B BNPL platform for international trade

Koverly unveiled a B2B buy now, pay later (BNPL) platform, offering businesses enhanced payment flexibility and reduced foreign exchange (FX) rates. The standout feature of the new KoverlyPay is the introduction of a 30-day extension on FX payments at no cost to either the buyer or seller, the global fintech startup said. Payments can be extended to four, eight or 12 fixed weekly installments, increasing cash flow and profitability. PYMNTS

BNPL closure hits unfunded NZ medicines

Access to unfunded medicines has been hit hard by the sudden closure of New Zealand’s only healthcare-specific buy now pay later platform, HealthNow. The platform allowed consumers to pay for healthcare and medication in up to 12 weekly installments, charging consumers less than the average market rate at only $7.00 per late payment after allowing for an extra 24-hour penalty-free grace period. Nga Hua Pharmacy pharmacist and co-owner James Yu said HealthNow wrapping up the scheme so quickly came as a shock. Newsroom

Klarna ‘doubles down’ as customers flock to BNPL in tough times

Klarna said UK BNPL sales volume grew 26% in the second quarter. Gross merchandise value or goods sold on its UK platform rose by 26% in the second quarter of 2023, with a 14% rise across Europe overall. Loss-making up to this point, Klarna now claims 100 million European consumers and deals with over 470,000 merchants. Klarna posted a loss of US$1 billion following a funding round in July that saw its value drop 85%. Proactive Investors

Amazon continues to bet on BNPL

Amazon is expanding its financial services footprint by letting retailers integrate Amazon Pay—its buy now, pay later (BNPL) option—within their checkout to reach a new audience of buyers looking for flexible payment options. According to Amazon, “the equal monthly payments offering is now available at tens of thousands of other online stores, including Lenovo, Tennis Express and Authentic Watches.” Payments Journal

Zorrz plans credit cards with built-in BNPL functionality

Zorrz has developed an artificial intelligence-powered tool called MoneyInsight360™, which generates a more complete, unified view of a person’s credit history. It will soon launch the BlueAccess Card, its flagship credit card designed specifically for immigrants, individuals with past credit challenges, and students. Sweden’s Sileon will provide the back-office technology and BNPL platform. Finextra

ShopBack, PayHalal offer Shariah-compliant BNPL

Shopping, rewards and payments platform ShopBack and payment gateway PayHalal will offer Shariah-compliant merchant acquiring services to provide shoppers with BNPL solutions. Under the partnership, merchants and brands enter a Wakalah service contract with PayHalal, enabling customers to make payments through ShopBack’s app via deferred payments by PayHalal’s payment gateway. The gateway supports a range of payment methods, including ShopBack PayLater. Malay Mail

BNPL’s rapid growth raises conflicting opinions on the ethics of short-term POS credit

The buy now, pay later craze, which took flight during the Covid pandemic, has become a $70-billion-plus segment of the payments industry. But that doesn’t mean it hasn’t stirred controversy among acquiring industry executives who manage versions of the point-of-sale credit product. Sources estimate total US BNPL loan volume will be nearly $72 billion this year, up almost 20% from 2022. Digital Transactions