According to several research reports, BNPL is busting out everywhere driven in large part by repeat users. Apple Pay Later finally rolled out to eligible US residents after testing with employees. Meanwhile, Walmart Canada launched BNPL for customers in partnership with Klarna. A PYMNTS survey shows Klarna is still at the top of BNPL provider rankings, followed by Affirm, Afterpay, and PayPal, among others. Amazon partnered with Affirm to launch pay later services for SMEs.

A NerdWallet survey found 18% of consumers intend to use BNPL to finance their holiday travel plans. Equipifi partnered with Generations FCU to introduce white-label BNPL services to its credit union members. UK consumer watchdog FCA intervened with several BNPL providers to ensure contracts were crystal clear for consumers, while oversight is also very much on the minds of the Credit Union National Association, which lobbied Capitol Hill legislators hard for regulations. BNPL use continues to rise, quickly exceeding oversight reach for now.

Amid inflation, BNPL growth is being driven by repeat users

Repeat purchases are driving much of the current business growth. Affirm reports 90% of its business last quarter came from repeat users, with an average of 3.9 transactions per customer. PayPal said three out of four of its Pay Later Millennial-aged customers use the service repeatedly. Afterpay, in a recent study from Oxford University, found nearly half its users used it more than once a month in the past year, and 61% said the service has helped them manage inflation. Modern Retail

Apple Pay Later launches in the US

Apple has launched Apple Pay Later for eligible US residents and it is currently available in the Wallet app on the iPhone. It allows users to divide purchases into four payments over six weeks, with no interest or fees. Customers can track, manage, and repay loans in the Apple Wallet, available for qualified purchases between $75 and $1000. The Paypers

Walmart offers buy now, pay later option in Canada

Walmart Canada is collaborating with Klarna to offer BNPL payment on its e-commerce site and via the retailer’s and Klarna’s mobile apps. By introducing Klarna’s BNPL service, Walmart Canada is enabling customers to split their purchase into four flexible, interest-free payments spread over six weeks. Orders between $50 and $4,000 across all product categories are eligible. Chain Store Age

Klarna unbeat at No.1 in PYMNTS provider ranking of BNPL apps

This month, PYMNTS’ Provider Ranking of Buy Now, Pay Later apps remains consistent. Klarna holds the top spot at 93, but Affirm is inching closer at 90, followed by PayPal (82), Afterpay (79), Zip (61), Sezzle (52), Laybuy (45), Humm (32), and ViaBill (19) rounding out the top nine scores. PYMNTS

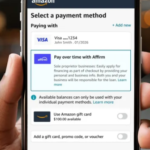

Amazon unveils BNPL option from Affirm for SMEs

Amazon is rolling out its first buy now, pay later checkout option for the millions of small business owners who use its online store, CNBC learned exclusively. The tech giant confirmed that its partnership with Affirm is expanding to include Amazon Business, the e-commerce platform for companies. The move boosts a crucial relationship for Affirm’s search for revenue growth after demand for expensive Peloton bikes collapsed. CNBC

More travelers using BNPL for holiday trips

Almost one in five holiday travelers (about 18%) plan to use a buy now, pay later service to pay for their holiday travel expenses, according to a NerdWallet survey conducted by The Harris Poll in September among over 2,000 US adults. For the purposes of the survey, holiday travelers were defined as people who plan to spend money on flights/hotels for 2023 holiday travel. El Paso Inc

Generations FCU launches BNPL on debit cards for members

GFCU has selected equipifi, a white label SaaS designed for financial institutions, to power its BNPL solution. By connecting equipifi to its banking core, GEN Pay extends personalized BNPL offers to members that align with their financial health on eligible debit card transactions. BNPL grew 25% in transaction value last year and is projected to surpass $100 billion by 2024. PRNewswire

UK watchdog intervenes again in ‘buy-now-pay-later’ as users rise

Britons are turning to unregulated “buy-now-pay-later” credit in ever increasing numbers to pay their bills, the Financial Conduct Authority said, in the latest sign of how the country’s cost of living crisis continues to bite. The watchdog said its latest Financial Lives survey showed that 27% of UK adults or about 14 million people, have used BNPL at least once in the six months to Jan 2023, up from 17% in the 12 months to May 2022. Reuters

BNPL growth outpacing prudential regulatory oversight

Credit unions are concerned that the exponential growth of “buy now, pay later” products has outpaced prudential regulatory oversight and will ultimately lead to consumer harm, CUNA wrote to a House Financial Services subcommittee for its hearing on innovation in financial services. CUNA encouraged the committee to explore this regulatory environment for BNPL providers and consider policy solutions. CUNA