Germany’s Mondu received FCA approval and went live with B2B BNPL financing for UK small businesses. Afterpay’s rewards program partnership with Nift is a strategic way to improve on-time payments and strengthen consumer credit. JD Power research finds BNPL is lightning its appeal from credit-challenged customers to financially healthy consumers. Klarna’s CEO told CNBC his company has loan losses 30 percent less than the industry average.

Australia’s Zip is off to a solid start to FY 2024 and projects profitability by year-end. US Bank launched its point-of-sale lending program, Avvance, offering variable rates and terms from three to 60 months. South Africa’s Happy Pay has had more than 15,000 active users since its launch in 2021. The B2B BNPL market is poised for significant growth given the €400 billion EU’s SME financing gap, which is even bigger in the US. Call it buy now, pay later, or split-pay — either way, BNPL continues to grow its market share globally with well-defined user personae.

B2B BNPL player Mondu registers with FCA and goes live in UK

Berlin-based B2B BNPL startup Mondu has registered with the Financial Conduct Authority (FCA) and will begin working with 16 British clients immediately. The UK launch comes after expansion into the Netherlands and Austria, with a variety of services, including, MonduOnline B2B BNPL for e-commerce checkout, and its recently launched MonduSell for multichannel sales, with flexible payment options of 30, 45, 60, and 90 days. Finextra

Why BNPL platform Afterpay is rewarding customers for on-time payments

Afterpay, the buy now, pay later platform owned by Block, is doling out brand-specific rewards for customers who pay on time. The company is pairing up with the gifting platform Nift to offer customers a gift of their choosing when they make their second on-time payment. Those who do so can head to the “My Afterpay” section of the Afterpay app to choose a reward. Modern Retail

BNPL broadening to include financially strong borrowers, JD Power finds

While 28% of US consumers say they’ve taken out a BNPL loan at least once in the previous 90 days, 23% of financially healthy consumers surveyed say they use BNPL loans to finance purchases. By comparison, 32% of financially unhealthy consumers say they have used BNPL loans to finance a purchase. In addition, 61% of financially healthy consumers say they’ve used BNPL more than once in the previous 90 days. Digital Transactions

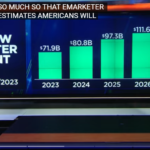

Klarna’s buy now pay later losses 30% below industry standard, says CEO

Sebastian Siemiatkowski, co-founder and CEO of Klarna , joins ‘The Exchange’ to discuss the type of consumer buy now pay later plans attract, the debt collection process for missed BNPL payments, and how investors can differentiate between buy now pay later providers. He said Klarna defaults are 30% lower than industry standards and it has grown to more than 35 million US users. CNBC

Buy now, pay later co Zip enjoying strong start to FY24

Zip Co has returned to cash-earnings profitability in the first quarter for the first time since interest rates started rising from near zero. The buy now, pay later company said on Tuesday it expected to be cash earnings positive for 2023/24, rather than just for the second half of the financial year with a strong performance in both of its core markets, Australia and New Zealand and the US and Canada. The West Australian

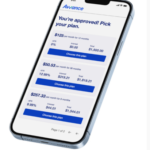

US Bank claims spot in the BNPL space

The launch of the point-of-sale option Avvance comes as nearly one in five consumers surveyed by the New York Fed say they’ve used BNPL loans in the past year. An Avvance button will now pop up at checkout on the websites of participating retailers, which Rob Seidman, US Bank’s chief product officer for point-of-sale lending/BNPL, said was an “actively growing” list of merchants. Banking Dive

Happy Pay already has 15,000 South African users

Happy Pay is here and redefining the buy now pay later system. Not only that but it has brought a modern approach to financing and it’s already boasting 15,000 users. CEO Wesley Billett says the company is trying to encourage responsible use and financial inclusion for consumers and under banked customers. eNCA

The consumerization of short-term lending solutions: BNPL in B2B

The B2B BNPL opportunity is huge. While the average basket value in B2B is significantly higher than in B2C, business-focused BNPL is expected to be less regulated than B2C BNPL. SMEs have long struggled to receive financing from their traditional banks or short-term lending solution providers. A 2019 European study identified the SME financing gap in the Eurozone to be €400 billion, and this gap is considered even wider in North America. The Paypers

Buy now, pay later is having its Kleenex moment

There are three distinct point-of-sale split-pay personas: those who have credit cards (from a merchant or from a card issuer) and also use point-of-sale split-pay credit options from time to time (56% of consumers), those with credit cards (from a merchant or from a card issuer) and who do not (30% of consumers), and those without any credit cards who use FinTech programs to make and pay for purchases (4.4% of consumers). The remaining 10% do not have credit cards (from a merchant or from a card issuer) and do not use split-pay plans. PYMNTS

Recent BNPL Report news:

BNPL Report: Oct 19 – Klarna AI, EU growth, Zilch Up, Waylog, Marqeta-Scalapay, Equipifi, Galileo